After a rather sleepy 2022 regarding tax and retirement plan changes, many rules impacting retirement planning will take effect in 2023. In this month’s article we’re going to highlight some of what we consider to be changes of specific importance, and how these changes might impact folks like you. Many of these changes may impact your long-term written retirement and estate plans. As a result, 2023 will likely be a year that you want to pay particular attention to at review time to ensure that you understand which changes apply to you and what actions you might want to take as a result.

2023 Social Security Cost of Living Adjustment (COLA)

After a year of extraordinary inflation, Social Security has announced the 4th largest cost of living adjustment in history. Effective January 1st, 2023, the COLA will be 8.7%. It’s been 20 years since we’ve seen a COLA adjustment anywhere near this. After last year’s extra ordinary increase of 5.9%, this year’s COLA the average adjustment over the past 20 years is 2.57%, which is more in line with historical inflation data.

Those who are already receiving benefits will see an increase in their January payment. Those who have not claimed Social Security yet but are age 62 or older will also receive the cost-of-living adjustment applied to their future benefits. Even while taking a delayed strategy to enhance your future household and survivor benefits, you too are benefiting from the COLA too.

The Social Security cost-of-living adjustment is written into law. The COLA is not determined by an elected or unelected bureaucrat. Rather it is a formula that is used to determine the cost-of-living adjustment is based off changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI – W) comparing the 3rd quarter of the current year to the same time period from the previous year. The Social Security COLA is one of the primary reasons why it is such a unique and significant retirement resource. One that should be carefully analyzed and evaluated before making an irrevocable decision.

Medicare Premiums Are Decreasing (Slightly)

In recent years we’ve become accustomed to rising Medicare premiums that often consume any COLA applied to Social Security benefits. For example, in 2022 the COLA for Social Security was 5.9%, but the rise in Medicare premiums was over 14% effectively wiping out the increased annual income for many Social Security recipients.

However, this year Medicare premiums have decreased. 2023 Medicare part B premiums for example are set at $164.90, down from $170.10 in 2022. That’s a 3% decrease during a period where most expenses for the average retiree have risen by 8% or more. The decrease in premiums appears to be a result of a surplus created by the large premium increase in 2022 premiums. Lower than projected spending in 2022 resulted in a much larger reserve in the part B account of the Supplemental Medical Insurance (SMI) Trust Fund. This will be a welcome relief for many retired individuals who are receiving Social Security benefits, and Medicare benefits.

The estimated average monthly Medicare Part D prescription drug coverage on the other hand is projected to increase to $43, up from $39 in 2022. That’s a 10% increase year over year. While Medicare Part A is premium $0 for most recipients who have at least 40 qualifying quarters there are other cost-sharing measures to consider. According to the CMS.gov website deductibles and coinsurance for Medicare part A services will increase slightly over 2022.

Most folks are eligible to receive Medicare benefits, beginning at age 65, however, those who are still working and covered under a qualified healthcare plan from their employer may choose to remain on the employer’s medical plan rather than switching to Medicare. We recommend visiting with our Medicare specialists to evaluate your options before taking any action.

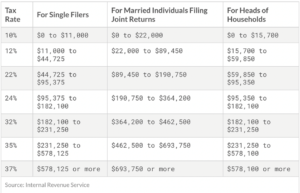

Tax Brackets Increase for Inflation

In 2023 tax brackets will increase for inflation. The increase is equal to about a 7% difference over 2022. How does this impact you?

You may likely be able to show more income in 2023 than you did in 2022 without your tax liability increasing. If your income remains flat, year-over-year, you may have the ability to make additional distributions from a pre-tax account like an IRA or 401K or convert IRA assets to Roth IRA assets without pushing yourself into a higher effective tax rate.

Standard Deduction Increases

The standard deduction is also increasing in 2023. Most taxpayers elect to file a standard deduction, rather than an itemized deduction. The standard deduction for a married couple filing jointly in 2022 was $25,900. There was an additional deduction of $1,400 for each person over the age of 65, therefor a retired married couple in which both spouses over the age of 65 would have a standard deduction of $28,700. In 2023 the standard deduction will increase to $27,700 and an additional $1,850 for each spouse over the age of 65 for a maximum standard deduction over $31,400.

With an increase in the standard deduction, additional dollars that would’ve been taxable upon distribution from a pre-tax account are effectively eliminated by the increase in the standard deduction. For those on a fixed income, this may give you additional room to make distributions from an IRA or other qualified plan, or to do additional Roth conversions without triggering a higher effective tax rate.

Combined with the increase of the tax brackets many folks may be able to convert larger portions of pre-tax (forever-taxed) accounts like IRAs to a never-taxed account Roth IRA in 2023.

Changes to the State of Iowa Income Tax

Recently passed legislation in the state of Iowa takes effect in 2023. Distributions from retirement accounts like IRAs and 401Ks and income from taxable pensions and annuities will no longer be taxed at the state level so long as the owner is age 55 or older. For example, if you are over the age of 55 and make a $10,000 distribution from your IRA in 2023, as a State of Iowa resident you will no longer be required to pay state income tax on the distribution. Federal taxes will apply however, and there’s a penalty for withdrawing from a retirement account prior to reaching age 59 1/2.

This will bring much needed relief to Iowa resident retirees, and perhaps make Iowa a much more attractive place for retirees to live (except for our winter weather).

We also anticipate that the new changes will help folks who are looking to reduce future tax liability to make larger Roth conversions beginning in 2023. Those over age 55, who are strategic thinkers and wanting to reduce future tax liabilities may find it advantageous to make larger Roth conversions beginning in 2023. This is because they will be able to take advantage of the remaining years of the Tax Cuts and Jobs Act federal tax rates which sunset at the end of 2025 but avoid paying state income tax on these conversions. Greater capacity for Roth conversions at a lower tax rate at the federal level, and no taxation at the state level should get many folks thinking about being more aggressive on converting forever taxed money to never taxed money as part of their retirement income strategy, as well as a wealth transfer strategy. Although conversions are still taxed at the federal level, conversions unlike distributions are not hit with a 10% penalty for early withdrawal so long as the converted assets are held in a Roth IRA for 5 years prior to making a withdrawal. Therefore, folks ages 55 and older may benefit tremendously by making large conversion in 2023, 2024, and 2025 when you take into consideration all of the mentioned changes: Increased Tax Brackets, Higher Standard Deduction, Elimination of Iowa State Income Tax on retirement accounts for those age 55 or older

Qualified Plan Contribution Limit Increases

For those who are still working and making contributions to qualified plans, both IRAs and 401(k) contribution limits will increase for 2023. In 2023 individuals making contributions into an IRA can contribute up to $6,500 which is up $500 from previous years. If you’re over, age 50, you can contribute an additional $1000 for a total of $7500. To contribute you must have earned income. If you are retired and have no earned income, even though you may have taxable income from a pension for example, you are not eligible to make contributions. However, if you do work part time for fun or otherwise, and you wish to make contributions for yourself as well as a non-working spouse you are free to do so up to the total of your earned income, or the maximum IRA contribution for 2023, whichever is less.

For folks contributing to 401(k)s, you will now be able to direct up to $22,500 of your compensation to your employer sponsored retirement plan. This is up from $20,500 in 2022. For folks who are over the age of 50 they may also make catch-up contributions of up to $7,500 into an employer sponsored plan for a total of $30,000.

Secure Act 2.0

In the waning hours of 2022 congressed passed a $1.7 trillion spending bill. Included in the final bill was a piece of legislation known as the Secure Act 2.0. The Secure Act 2.0 builds off the Setting Every Community Up for Retirement (SECURE) Act of 2019.

Not long after the ink dried on the original SECURE Act talk of a SECURE Act 2.0 began to circulate. Legislators felt there was more work to be done to make it easier for hard-working Americans to save towards their retirement, give more employees access to an employer sponsored retirement plan, and to incentivize employers to make it so.

The Secure Act 2.0 is over 100 pages in length and will undoubtedly impact many of the folks that we serve; those who are currently preparing to transition into retirement, and those already living out their retirement years.

Next month’s article will address the finer points of the SECURE Act 2.0 of 2022, but here are a handful of things to come:

- Changes to the age at which Required Minimum Distribution (RMD) are required to begin from retirement plans, both IRAs and workplace sponsored retirement plans starting in 2023.

- Never-taxed Roth options for SIMPLE and SEP IRAs will be available for the first time ever in 2023.

- Rollovers will be permitted from 529 plans into Roth IRAs albeit with several nuanced details about who, when, how they can, and for whose benefit beginning in 2024.

- Employer contributions such as matching or non-elective contributions may be made to the Roth portion of an employee’s workplace plan like a 401K or a 403b beginning in 2023.

- An additional class of catch-up contributions cohorts will be created beginning in 2025 allowing those ages 60 thru 63 to make an additional $10,000 catch-up contributions to workplace retirement plans on top of the inflation adjusted catch-up contributions that already exist to help those late starters get back on the retirement-savings track.

- There’s a new death benefit options for a surviving spouse of a retirement plan or IRA owner to elect beginning in 2024.

This is only a small taste of what is to come in next months newsletter. There are so many details to drill into within each of the provisions. There are many more noteworthy provisions that haven’t even been mentioned yet. A handful of them will apply as early as tax year 2023 while many are not effective until years to come. Many details have yet to be flushed out, and we should know more regarding how the new rules will be interpreted and administered in the coming weeks, months, and years.

Nevertheless, it is important to be aware of the rapidly changing landscape, and how it may impact your own written retirement strategy. Some changes may be irrelevant to you while other changes may require that you act to optimize your plans and minimize taxes. If you are one of the many valued TWFG client family members that we currently serve, know that we’ll strive to guide you to and through the SECURE Act 2.0 as it applies to your specific situation. For those of you who are not part of our client family we hope you find some value in our content and that it makes a positive impact as you plan for your future.

Stay tuned for more details coming soon!